Little Heros Blood Drive

Sep 27, 2021

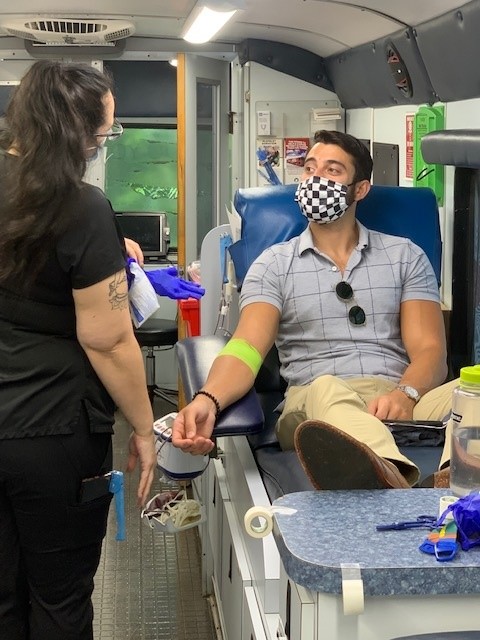

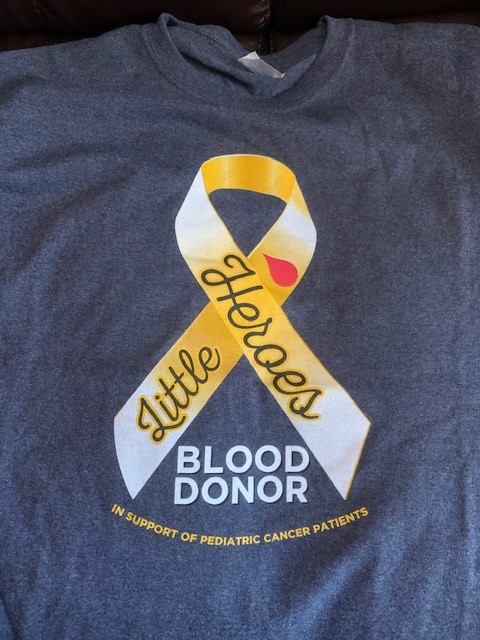

There is probably nothing that pulls at the heart-strings more than a sick child or a child in need. Imagine getting the news that your child has cancer. Its tough for any parent to even think about that, let alone live it. Through the OneBlood organization and the Little Heros Campaign here in Charlotte, 40 mobile unit blood drives have been set up throughout the month of September (and into early October) to allow each of us to help save a child who may be fighting the battle of his life … or fighting for his life. Managing Director Ed Doughty and Financial Advisor Jason Dimitriou both donated their blood in honor of Liam Flynn, the young son of personal friend who is actually the one who helped to organize the month-long blood drive. Donating blood is such a simple way to “give”, but the results of your giving can literally help to save a life. We were grateful for the opportunity to give, and would encourage everyone to considering donating to the Little Heros Blood Drive. You can simply enter your zip-code and find a listing of all the remaining blood drives near year. Go to: Little Heros Blood Drive

More Insights

The S&P 500 strung together 37 record highs this year aboard an 18.1% rally, as of July 10. The advance has largely been powered by a handful of mega cap names tied to technology and/or artificial intelligence. In fact, six stocks — NVIDIA (NVDA), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Meta (META), and Alphabet (GOOG/L) … Continue reading “Market Performance is a Tale of Haves & Have-Nots”

Investors are people, and people are often impatient. No one likes to wait in line or wait longer than they have to for something, especially today when so much is just a click or two away.

You can prepare for the transition years in advance. In doing so, you may be better equipped to manage anything unexpected that may come your way.

When developing your estate plan, you can do well by doing good. Leaving money to charity rewards you in many ways. It gives you a sense of personal satisfaction, and it can save you money in estate taxes.

How healthy a retirement do you think you will have? If you can stay active as a senior and curb or avoid certain habits, you could potentially reduce one type of retirement expense. Each year, Fidelity Investments presents an analysis of retiree health care costs. In 2023, Fidelity projected that the average 65-year-old couple would … Continue reading “Retirement Wellness”

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page