Can Pre-Election Market Trends Survive This Attention?

Apr 8, 2024

Let’s talk seasonality. For those that are unfamiliar, seasonality is the tendency for markets to perform better during some calendar periods and worse during others in a somewhat predictable way. One of the more amazing things about 2023 and part of the first quarter of 2024 is how well U.S. equity markets have been following the historical pre-presidential election seasonal path. The idea of the presidential cycle is predicated on the belief that the executive branch’s economic pursuits, priorities, and the desire to get re-elected are a primary influence on the stock market in the two years before an election. One could even argue that this influence is more relevant today than before, given the heavy fiscal-interventionist approaches that the current and previous administrations have pursued.

Let’s talk seasonality. For those that are unfamiliar, seasonality is the tendency for markets to perform better during some calendar periods and worse during others in a somewhat predictable way. One of the more amazing things about 2023 and part of the first quarter of 2024 is how well U.S. equity markets have been following the historical pre-presidential election seasonal path. The idea of the presidential cycle is predicated on the belief that the executive branch’s economic pursuits, priorities, and the desire to get re-elected are a primary influence on the stock market in the two years before an election. One could even argue that this influence is more relevant today than before, given the heavy fiscal-interventionist approaches that the current and previous administrations have pursued.

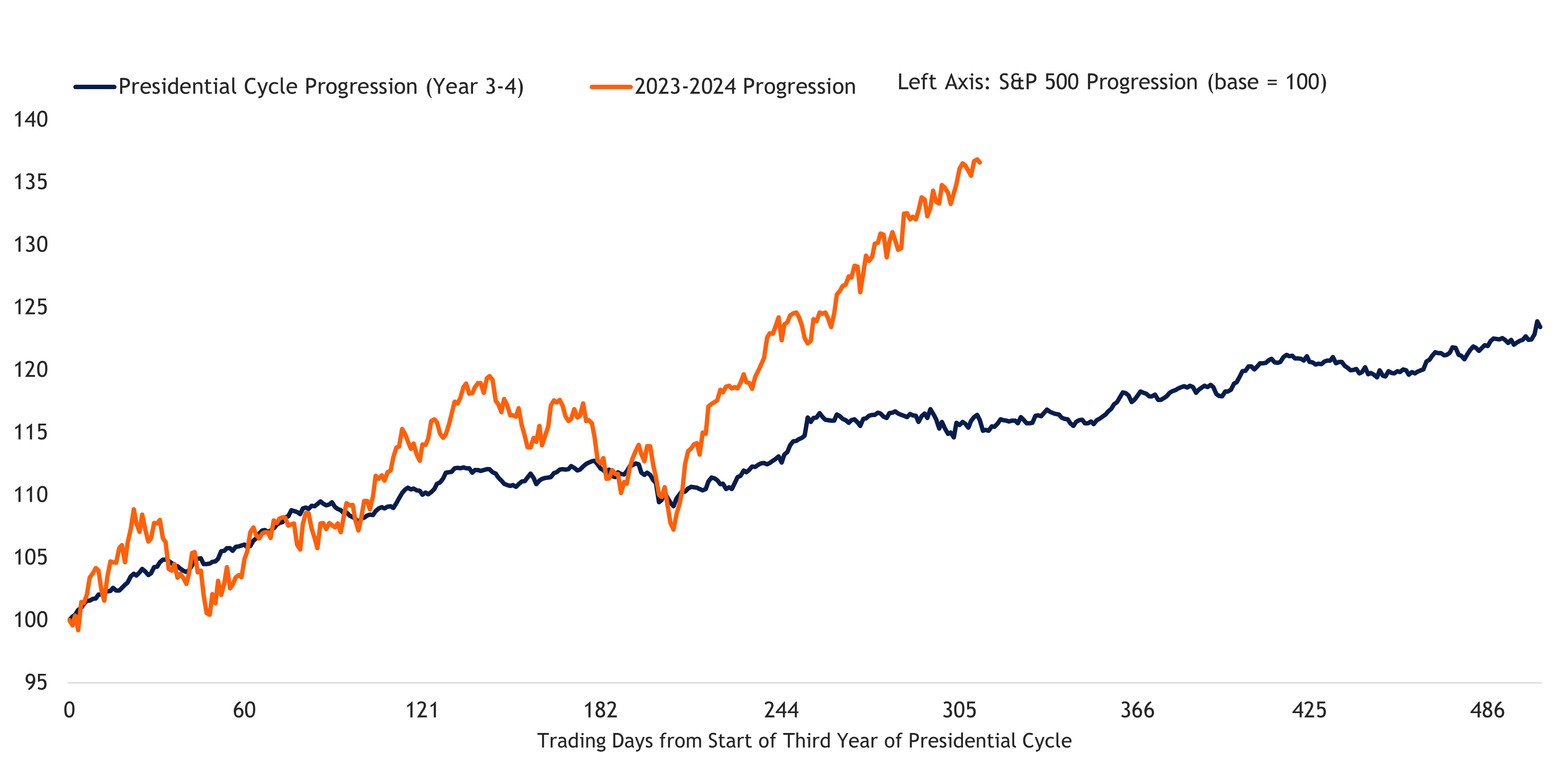

As the chart below details (focus less on the amplitudes in price and more on the turning points), the S&P 500 has been following the election calendar seasonality rather well over the last year, as most of the zigs and zags have occurred when the presidential cycle seasonality suggested it would. However, as this pattern has evolved and become more visible, it has become more widely discussed and may add risk over the next few months. Widely watched things in markets have a habit of not working for very long, as too many participants collectively acting on the same thing will inherently disrupt the pattern and can alter the path that the market is headed in. Over the last few weeks, we have seen the S&P 500 more noticeably deviate course. Only time will tell if the current presidential cycle seasonality is ending early, but next month should shed some light on that question. If the S&P 500 is still following the suggested seasonal path, then weakness and a low in May would be expected to be followed by strength in the index over the summer. However, if the current uptrend fails to pause in May or we notice weakness develop and extend well into June, then it will be a strong sign that this round of election year seasonality has indeed subsided early.

S&P 500 Progression During Year Three and Four of Presidential Cycle (1951–YTD)

Source: LPL Research, Bloomberg 04/01/24

Disclosures: All data as of 1951–YTD. Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of predecessor index, the S&P 90.

For more insights and resources, be sure to sign up for our Weekly Market Commentary. Follow our YouTube channel where we regularly post our Epic Market Minute videos. Follow us on LinkedIn, or like us on Facebook. And as always, please don’t hesitate to reach out to a dedicated service professional at Epic Capital.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing. Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk. Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy. Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Asset Class Disclosures – International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. Bonds are subject to market and interest rate risk if sold prior to maturity. Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply. Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features. Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses. Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk. High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors. Precious metal investing involves greater fluctuation and potential for losses. The fast price swings of commodities will result in significant volatility in an investor's holdings. Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC. Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

More Insights

April showers came a month early as stocks fell in March. Tariffs were the primary cause of the market jitters, although that uncertainty became too much for markets to shrug off once economic data started to weaken.

A successful investor maximizes gain and minimizes loss. Though there can be no guarantee that any investment strategy will be successful and all investing involves risk, including the possible loss of principal, here are six basic principles that may help you invest more successfully.

Losing a spouse is a stressful transition. And the added pressure of having to settle the estate and organize finances can be overwhelming. Fortunately, there are steps you can take to make dealing with these matters less difficult.

Families are one of the great joys in life, and part of the love you show to your family is making sure that their basic needs are met. While that’s only to be expected from birth through the high school years, many households are helping their adult children well into their twenties and beyond at … Continue reading “Retirement and Adult Children”

Life insurance can be an excellent tool for charitable giving. Not only does life insurance allow you to make a substantial gift to charity at relatively little cost to you, but you may also benefit from tax rules that apply to gifts of life insurance.

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page