Market Update – Assessing the Prospect for a Pullback

Apr 12, 2024

In baseball, three strikes and you’re out. With inflation, a third straight month of hotter-than-expected consumer inflation data nearly ruled out probabilities for a June rate cut yesterday (now less than a 25% chance, according to fed funds futures). The core Consumer Price Index (CPI) rose 0.4% in March, or 3.8% when compared on a 12-month basis, topping respective estimates of 0.3% and 3.7%. Investors quickly dialed back rate-cut expectations on the news, pushing Treasury yields up by 0.15% to 0.20% and stocks down around 1%.

In baseball, three strikes and you’re out. With inflation, a third straight month of hotter-than-expected consumer inflation data nearly ruled out probabilities for a June rate cut yesterday (now less than a 25% chance, according to fed funds futures). The core Consumer Price Index (CPI) rose 0.4% in March, or 3.8% when compared on a 12-month basis, topping respective estimates of 0.3% and 3.7%. Investors quickly dialed back rate-cut expectations on the news, pushing Treasury yields up by 0.15% to 0.20% and stocks down around 1%.

Based on the breakout higher in Treasury yields, the message from the fixed income market yesterday appeared to be ‘not so fast’ regarding the timing of an interest rate cut, echoing the patient tone of the Federal Reserve (Fed). Based on the breakdown below the S&P 500’s uptrend, the message from the equity market yesterday served as a warning sign for a potentially deeper pullback.

As highlighted in the chart below, the S&P 500 violated an uptrend/20-day moving average (dma) yesterday — a consistent spot for buyer demand on dips. When support no longer acts as it should, be on alert, especially if there are correlative signs of macro conditions potentially changing.

The bottom panel features 10-year Treasury yields and their breakout above 4.35% yesterday, an important resistance level tracing back to the October 2022 highs. As highlighted, yields last broke out above this area in August 2023, and the subsequent advance in yields proved to be too much, too fast for equity markets to absorb. While we are not suggesting a correction is imminent or that stocks and bonds will follow the exact same path, the shift in risk appetite after yields topped 4.35% last summer provides another warning for a potential pullback in stocks.

Stocks Down, Yields Up

The breakout higher on 10-year Treasury yields could weigh on risk appetite.

Source: LPL Research, Bloomberg 04/10/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

A pullback or even correction is nothing out of the ordinary for a strong bull market. Market breadth remains expansive, offensive sectors are leading, credit spreads and implied volatility remain historically low, and longer-term momentum implications of this rally all suggest dips should be bought.

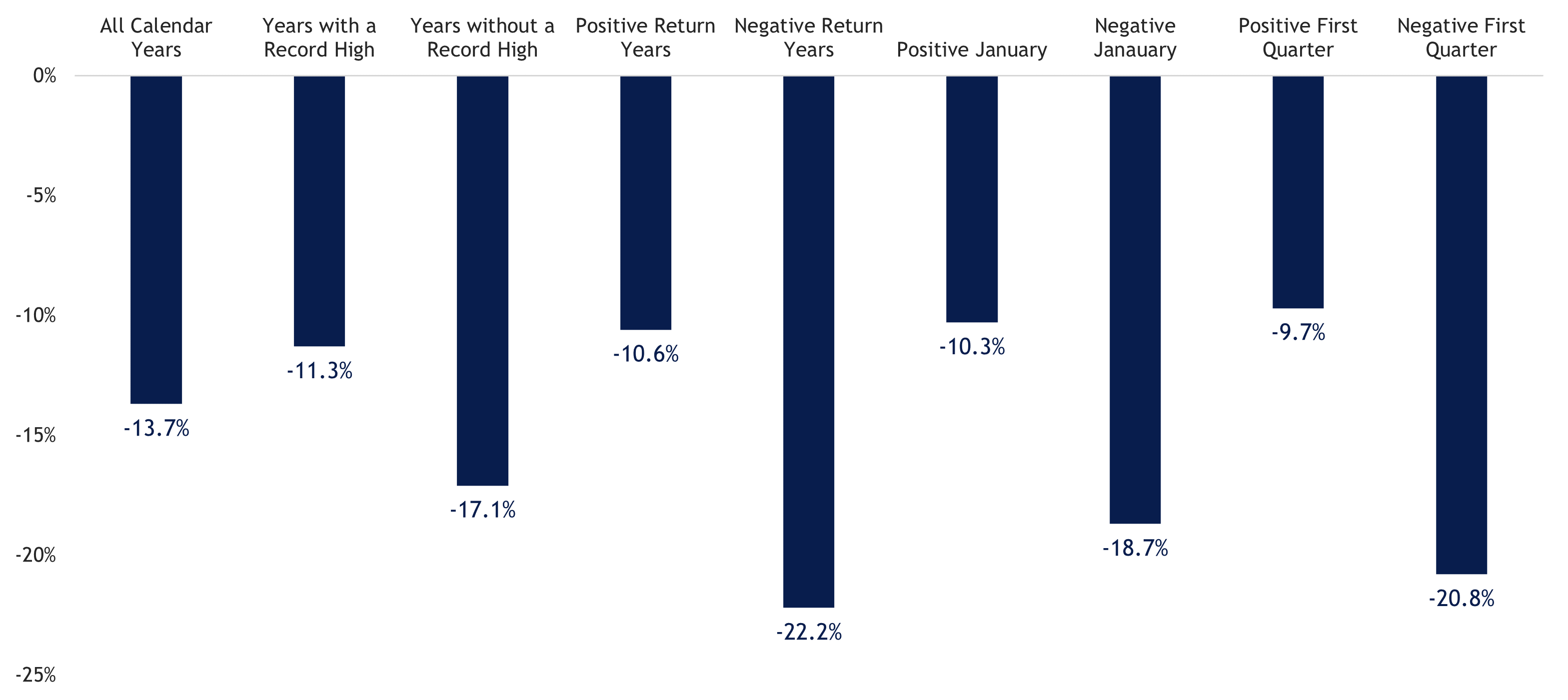

To better assess what a pullback could appear like on the S&P 500, we analyzed various drawdown scenarios dating back to 1950. For all years across this time frame, the average maximum drawdown for the index has averaged -13.7%. However, drawdowns are less severe during years that include record highs, a positive January, and a positive first quarter — all characteristics of 2024.

Drawdown Scenarios for the S&P 500 (1950-2023)

Source: LPL Research, Bloomberg 04/10/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Summary

Stocks have enjoyed a strong and steady climb higher this year with extremely low volatility. Momentum indicators have started to sputter as stocks begin to experience some technical damage. The violation of the S&P 500’s 20-dma and corresponding breakout in 10-year Treasury yields points to a percolating risk for a deeper pullback. We consider 4,800 as a worst-case scenario for a drawdown on the S&P 500 but note there are several support levels to get through on the way down, including the 50-dma at 5,100 and the 5,000-point milestone. Confidence for a relatively shallow drawdown is primarily supported by broad market breadth, cyclical leadership trends, economic resiliency, historically narrow credit spreads, and the longer-term momentum implications of this rally.

For more insights and resources, be sure to sign up for our Weekly Market Commentary. Follow our YouTube channel where we regularly post our Epic Market Minute videos. Follow us on LinkedIn, or like us on Facebook. And as always, please don’t hesitate to reach out to a dedicated service professional at Epic Capital.

IMPORTANT DISCLOSURES:

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing. Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk. Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy. Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Asset Class Disclosures – International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. Bonds are subject to market and interest rate risk if sold prior to maturity. Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply. Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features. Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses. Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk. High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors. Precious metal investing involves greater fluctuation and potential for losses. The fast price swings of commodities will result in significant volatility in an investor's holdings. Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC. Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

More Insights

Key Takeaways Volatility came back with a vengeance this week as selling pressure in the mega cap space dragged down the broader market. Counterbalancing weakness in these heavyweight names poses a challenge for the rest of the market. Overbought conditions can also be blamed for the recent weakness. The S&P 500 reached a 14.9% premium … Continue reading “Market Update – Assessing the Technical Damange”

Life insurance can be an excellent tool for charitable giving. Not only does life insurance allow you to make a substantial gift to charity at relatively little cost to you, but you may also benefit from tax rules that apply to gifts of life insurance.

When you think of Social Security, you probably think of retirement. However, Social Security can also provide much-needed income to your family members when you die, making their financial lives easier. Your family members may be eligible to receive survivor benefits if you worked, paid Social Security taxes, and earned enough work credits. The number … Continue reading “Social Security Survivor Benefits”

Information vs. instinct. When it comes to investment choices, many people believe they have a “knack” for choosing good investments. But what exactly is that “knack” based on? The fact is, the choices we make with our assets can be strongly influenced by factors, many of them emotional, that we may not even be aware … Continue reading “Making Investment Choices”

As a business owner, you should carefully consider the advantages of establishing an employer-sponsored retirement plan. Generally, you’re allowed certain tax benefits for establishing an employer-sponsored retirement plan, including a tax credit for establishing the plan and a deduction for contributions you make. In return, however, you’re required to include certain employees in the plan, … Continue reading “Retirement Plans for Small Businesses”

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page