Market Update: The Fed Remains Unchanged Again

Nov 3, 2023

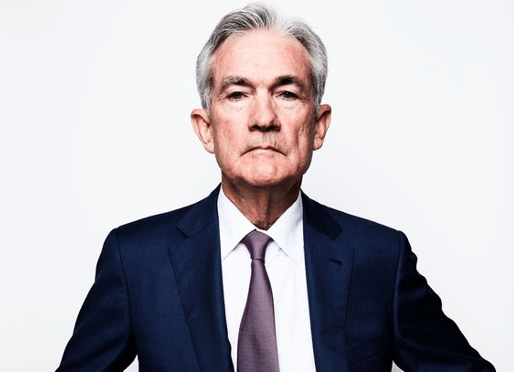

In a unanimous decision yesterday, The Federal Reserve (Fed) left interest rates unchanged following its Federal Open Market Committee (FOMC) meeting. This marks the second straight meeting in which a rate hike was skipped, however, Chair Jerome Powell, didn’t rule out future increases. For now, the target rate remains at 5.25%-5.50%. Markets reacted positively to the news as stock prices rallied and bond yields fell.

Leaving the Door Open

The FOMC’s November Statement maintained the possibility of future rate hikes as they remain “highly attentive to inflation risks”. The Committee is still determining the lagged effects of the current monetary policy, as Powell stated, “the full effects of our tightening have yet to be felt”.

It believes both the financial and credit conditions will likely weigh on overall economic activity for households and businesses. As mortgage rates recently reached 8%, and the average credit card rate sits at over 20%, high borrowing costs are omnipresent for consumers and businesses alike. A broader measure of the Fed’s monetary policy stance can be gleaned from the Proxy Funds Rate, which takes into account wider measures of financial conditions that aren’t necessarily tethered to the fed funds rate. The chart below shows a divergence in the fed funds rate and the Proxy Funds Rate, indicating more strain on financial market conditions than would otherwise be measured by the fed funds rate.

Wage Growth

While Wednesday’s Fed statement remained largely unchanged from the prior meeting, Powell did make a surprisingly positive statement on wage growth during the post-meeting press conference. Referencing Tuesday’s release of the Employment Cost Index (ECI) Powell noted that “If you look at the broad range of wages, the wage increases have really come down significantly over the course of the last 18 months to…where they’re substantially closer to that level that would be consistent with 2% inflation over time”. The ECI data showed private industry employment costs rose 4.3% year-over-year, compared with 5.2% the same month last year. Committee members expect to see some deterioration in the labor market before inflation reaches the long run target and would warmly welcome continued gradual moderation in wages.

Risks Balancing Out

At the start of the rate hiking campaign over 18 months ago, the predominant concern was targeting an appropriate interest rate level to prevent inflation from becoming entrenched. As we stand today, that predominant concern has become more balanced with a competing concern if they’re doing “too much”. The Committee is proceeding carefully, with the risks of higher interest rates becoming more two-sided. Although the economy grew at 4.9% annualized in Q3, the Atlanta Fed’s GDPNow growth tracker is projecting 1.2% for Q4. As inflation continues to moderate, albeit still not at its long-term target, the Fed now has the luxury of more heavily considering the economic growth outlook, as witnessed by a second straight pause.

Bottom Line

The Fed will continue to try to determine the proper level of interest rate policy as it goes “meeting-by-meeting”. We’ve seen dot plot projections deteriorate over longer periods. Members’ forecasts are fluid, as they search for unambiguous and decidedly consistent data relating to inflation, employment, and overall economic health. It may lean towards a hiking bias in the December meeting as they’re still not assertively confident that the current policy is restrictive enough, but incoming data will heavily influence the next move.

IMPORTANT DISCLOSURES This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing. Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. For more information on the risks associated with the strategies and product types discussed please visit https://lplresearch.com/Risks References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy. Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC. Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

More Insights

You don’t want to pay more in federal income tax than you have to. With that in mind, here are five things to consider when it comes to keeping more of your income.

There’s a subjective uncertainty associated with financial wellness. Are you financially fit? And if so, how fit are you? While there is no clearly defined threshold for answering affirmatively, much less grading your level of fitness, there are baseline elements associated with financial fitness. To make sure that you’re on the right track, develop a … Continue reading “Basics of Financial Fitness”

After a strong first quarter for stocks, some April showers rained down as the S&P 500 fell about 4% last month. Hopefully those showers will bring some flowers in May, despite the widely cited stock market adage, “Sell in May and go away.” There is some merit to this old adage because the S&P 500’s … Continue reading “Market Update – Navigating May’s Stock Market Outlook”

Families are one of the great joys in life, and part of the love you show to your family is making sure that their basic needs are met. While that’s only to be expected from birth through the high school years, many households are helping their adult children well into their twenties and beyond at … Continue reading “Retirement and Adult Children”

At some point in our lives, we may inherit a home or another form of real property. In such instances, we need to understand some of the jargon involving inherited real estate. What does “cost basis” mean? What is a “step-up?” What is the home sale tax exclusion, and what kind of tax break does … Continue reading “Explaining the Basis of Inherited Real Estate”

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page