How Markets Bottom

Mar 24, 2020

With US equities firmly in a bear market, even the most long-term investors are now looking ahead to when the selling may stop and where the S&P 500 Index might ultimately bottom. “Nobody knows exactly how this market bottom will play out,” said LPL Financial Senior Market Strategist Ryan Detrick. “However, using history as guide, we know markets tend to retest or even slightly break previous lows.”

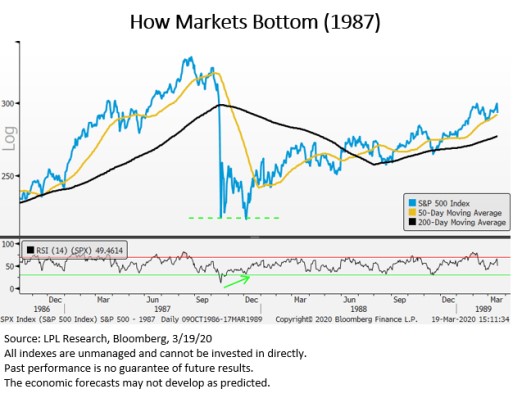

We took a look at how markets have bottomed for two previous bear markets that show similarities to the current sell-off, in terms of speed and magnitude. As shown in the chart below, following Black Monday, the largest single-day decline in the history of the S&P 500, the index rebounded modestly, before undercutting its lows about six weeks later. However, a look at the bottom panel shows that the momentum, or speed, of that move was significantly less extreme and markets went on to rally, ultimately eclipsing the 1987 peak less than two years later.

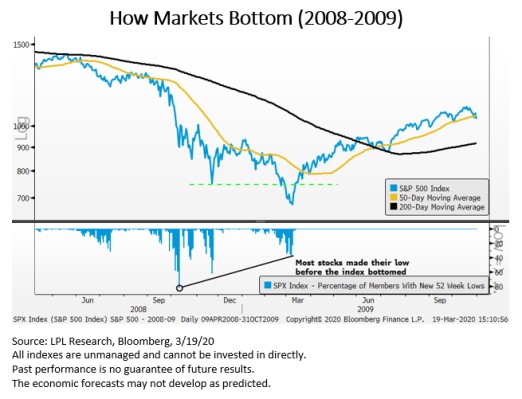

The 2008-2009 financial crisis tells a similar story. While the S&P 500 Index didn’t ultimately reach its low until March 2009, most stocks actually bottomed during the fall 2008, following the collapse of Lehman Brothers. Even though the S&P 500 undercut the October lows by a full 10%, this divergence, similar to the momentum observed in 1987, shows that things were improving under the surface even if the price of the index didn’t yet reflect it.

It may be too early to say that the initial leg of our current decline is done, but certainly we have seen extreme fear and a historic decline in markets. One positive—the S&P 500 has yet to close below its December 2018 lows. Soon it may be time to start hunting for signs of a bottom.

Tags: Current Events, Investing

More Insights

Key Takeaways Volatility came back with a vengeance this week as selling pressure in the mega cap space dragged down the broader market. Counterbalancing weakness in these heavyweight names poses a challenge for the rest of the market. Overbought conditions can also be blamed for the recent weakness. The S&P 500 reached a 14.9% premium … Continue reading “Market Update – Assessing the Technical Damange”

Life insurance can be an excellent tool for charitable giving. Not only does life insurance allow you to make a substantial gift to charity at relatively little cost to you, but you may also benefit from tax rules that apply to gifts of life insurance.

When you think of Social Security, you probably think of retirement. However, Social Security can also provide much-needed income to your family members when you die, making their financial lives easier. Your family members may be eligible to receive survivor benefits if you worked, paid Social Security taxes, and earned enough work credits. The number … Continue reading “Social Security Survivor Benefits”

Information vs. instinct. When it comes to investment choices, many people believe they have a “knack” for choosing good investments. But what exactly is that “knack” based on? The fact is, the choices we make with our assets can be strongly influenced by factors, many of them emotional, that we may not even be aware … Continue reading “Making Investment Choices”

As a business owner, you should carefully consider the advantages of establishing an employer-sponsored retirement plan. Generally, you’re allowed certain tax benefits for establishing an employer-sponsored retirement plan, including a tax credit for establishing the plan and a deduction for contributions you make. In return, however, you’re required to include certain employees in the plan, … Continue reading “Retirement Plans for Small Businesses”

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page