401(k) Loan Repayment

Dec 30, 2019

The conventional wisdom about taking a loan from your 401(k) plan is often boiled down to: not unless absolutely necessary. That said, it isn’t always avoidable for everyone or in every situation. In a true emergency, if you had no alternative, the rules do allow for a loan, but they also require a fast repayment if your employment were to end. Recent changes have changed that deadline, offering some flexibility to those taking the loan. (Distributions from 401(k) plans and most other employer-sponsored retirement plans are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 70½, you must begin taking required minimum distributions.) (more…)

Tags: 401K, Retirement Planning

Pension Plans & De-risking

Dec 25, 2019

A new term has made its way into today’s financial jargon: de-risking. Anyone with assets in old-school pension plans should know what it signifies.

De-risking is when a large employer hands over its established pension liabilities to a third party (typically, a major insurer). By doing this, the employer takes a sizable financial obligation off its hands. Companies that opt for de-risking usually ask pension plan participants if they want their pension money all at once rather than incrementally in an ongoing income stream. (more…)

Tags: financial advisor charlotte nc, retirement, Retirement Planning

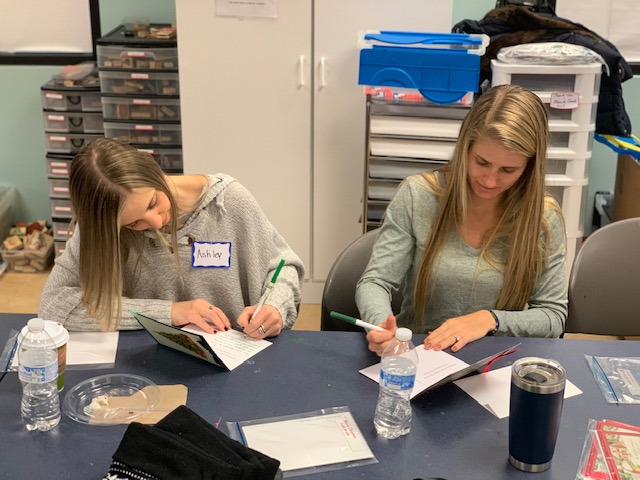

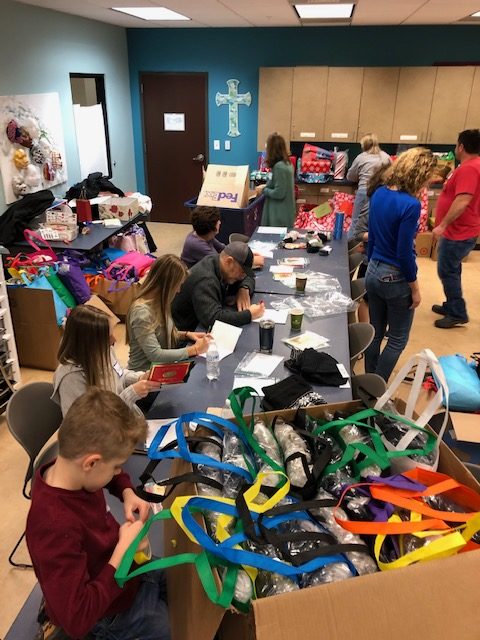

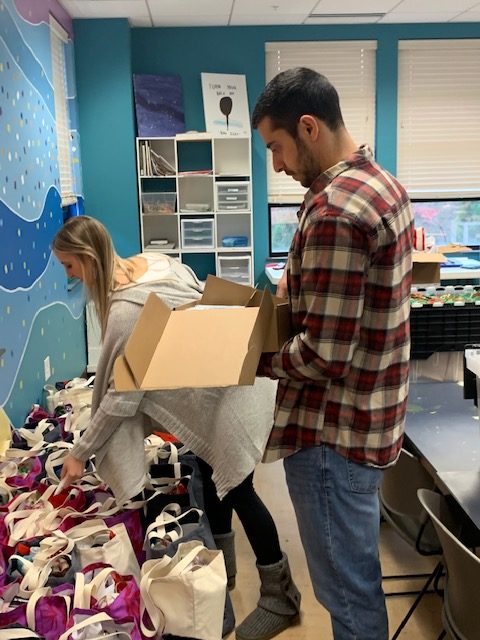

Dove’s Nest – Charlotte Rescue Mission

Dec 21, 2019

It was such a privilege to be the group that assembled the gift bags that were opened on Christmas morning by the women and children at Dove’s Nest. It was a clear reminder that the Christmas season truly is about giving, not just presents, but giving of one’s self for others, sharing our time and hearts and doing what we can to lift others up, to empower them, and to give them the dignity they deserve no matter their circumstances or life story. It’s also a perfect time to reflect on how blessed we are, and how grateful we are for the families that we serve doing the work we do at Epic Capital.

It was such a privilege to be the group that assembled the gift bags that were opened on Christmas morning by the women and children at Dove’s Nest. It was a clear reminder that the Christmas season truly is about giving, not just presents, but giving of one’s self for others, sharing our time and hearts and doing what we can to lift others up, to empower them, and to give them the dignity they deserve no matter their circumstances or life story. It’s also a perfect time to reflect on how blessed we are, and how grateful we are for the families that we serve doing the work we do at Epic Capital.

Dove’s Nest, Charlotte Rescue Mission’s cost-free women’s recovery program provides a structured yet loving and stable living environment aimed at helping women understand and deal with the core issues of addiction as a disease. The 120-Day program welcomes mothers with their children and focuses on spiritual, physical, social and psychological recovery, to help women understand and deal with the core issues of their alcohol and/or drug addiction. If you’d like to learn more about this extraordinary facility and program, please visit their website or give them a call @ 704-333-4673.

Four Words You Shouldn’t Believe

Dec 18, 2019

“This time is different.” Beware those four little words. They are perhaps the most dangerous words an investor can believe in. If you believe “this time is different,” you are mentally positioning yourself to exit the stock market and make impulsive, short-sighted decisions with your money. This is the belief that has made too many investors miss out on the best market days and scramble to catch up with Wall Street recoveries.

Stock market investing is a long-term proposition – which is true for most forms of investing. Any form of long-range investing demands a certain temperament. You must be patient, you must be dedicated to realizing your objectives, and you can’t let short-term headlines deter you from your long-term quest. (more…)

Tags: Investing, Investment Planning

A Retirement Facts Sheet

Dec 16, 2019

Does your vision of retirement align with the facts? Here are some noteworthy financial and lifestyle facts about life after 50 that might surprise you.

Up to 85% of a retiree’s Social Security income can be taxed. Some retirees are taken aback when they discover this. In addition to the Internal Revenue Service, 13 states currently levy taxes on some or all Social Security retirement benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. (West Virginia, incidentally, is phasing out such taxation.) (more…)

Tags: financial advisor charlotte nc, Retirement Planning

New I.R.S. Contribution Limits

Dec 13, 2019

The I.R.S. just increased the annual contribution limits on IRAs, 401(k)s, and other widely used retirement plan accounts for 2020. Here’s a quick look at the changes. (more…)

Tags: Retirement Planning

Establishing Good Credit in College

Dec 9, 2019

Good credit may open doors. It is vital to securing a loan, a business loan, or buying a home. When you establish and maintain good credit in college, you create a financial profile for yourself that can influence lenders, landlords, and potential employers.

Unfortunately, some college students do not have good credit. In fact, Credit Karma says that the average 18-to-24-year-old has a credit score of 630. A FICO score of 730 or higher is considered good. (more…)

Tags: Credit Repair, Financial Planner Charlotte NC, Financial Planning

Can You Put Your IRA into a Trust?

Dec 2, 2019

Can your IRA be put directly into a trust? In short, no. Individual retirement accounts (IRAs) cannot be put directly into a trust. What you can do, however, is name a trust as the beneficiary of your IRA. The trust would inherit the IRA upon your passing, and your beneficiaries would then have access to the funds, according to the terms of the trust.

Can you control what happens to your IRA assets after your death? Yes. Whoever was named the beneficiary will inherit the IRA. But you also can name a trust as the IRA beneficiary. In other words, your chosen heir is a trust. When you have a trust in place, you control not only to whom your assets will be disbursed, but also how those assets will be paid out. (more…)

Tags: financial advisor charlotte nc, ira

More Insights

Few terms in personal finance are as important, or used as frequently, as “risk.” Nevertheless, few terms are as imprecisely defined. Generally, when financial advisors or the media talk about investment risk, their focus is on the historical price volatility of the asset or investment under discussion.

As Americans get their grills and beach chairs ready for the July 4th holiday, the stock market and the weather across much of the country have both been on heaters. Stocks and bonds continue to effectively navigate a complex policy landscape shaped by evolving trade dynamics, geopolitical tensions, and fiscal stimulus. The market’s resilience in … Continue reading “Market Update – America Gets Record High Stock Prices for Its Birthday”

Birthdays may seem less important as you grow older. They may not offer the impact of watershed moments such as getting a driver’s license at 16 and voting at 18. But beginning at age 50, there are several key birthdays that can affect your tax situation, health-care eligibility, and retirement benefits.

During times like these when geopolitical headlines can be unsettling for investors, we at LPL Research like to remind ourselves of one of our key investing principles. Markets have always faced challenges —ranging from geopolitical conflicts and economic downturns to natural disasters, political upheaval and health crises. These events often trigger short-term volatility and shake … Continue reading “Why Long Term Investing Beats Selling in Volatile Times”

Are you concerned about the inheritance taxes your heirs may have to pay? Then you may want to consider creating charitable lead trusts.

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page