Retirement Plans for Small Businesses

Jul 17, 2024

As a business owner, you should carefully consider the advantages of establishing an employer-sponsored retirement plan. Generally, you’re allowed certain tax benefits for establishing an employer-sponsored retirement plan, including a tax credit for establishing the plan and a deduction for contributions you make. In return, however, you’re required to include certain employees in the plan, and to give a portion of the contributions you make to those participating employees. Nevertheless, a retirement plan can provide you with a tax-advantaged method to save funds for your own retirement, while providing your employees with a powerful and appreciated benefit.

As a business owner, you should carefully consider the advantages of establishing an employer-sponsored retirement plan. Generally, you’re allowed certain tax benefits for establishing an employer-sponsored retirement plan, including a tax credit for establishing the plan and a deduction for contributions you make. In return, however, you’re required to include certain employees in the plan, and to give a portion of the contributions you make to those participating employees. Nevertheless, a retirement plan can provide you with a tax-advantaged method to save funds for your own retirement, while providing your employees with a powerful and appreciated benefit.Tags: financial advisor charlotte nc, Financial Planning, Personal Finance, retirement, tax guide, Wealth Building

Investment Challenges of the Affluent Investor

Jun 28, 2024

High net worth investors face investment challenges that some would consider unique to their financial status. The fundamental tenets of investing apply just as equally to them as any other investor, but these investors need to be mindful of issues that typically arise only from substantial wealth.

Let’s examine a few of these.

Tags: charlotte NC, financial advisor, financial advisor charlotte nc, Financial Planning, Investment Planning, Investment Portfolio, Investments, Personal Finance

Couples Retiring on the Same Page

Jun 24, 2024

What does a good retirement look like to you? Does it resemble the retirement that your spouse or partner has in mind? It is at least roughly similar?

The Social Security Administration currently projects an average of 18 years for a retiring man and 21 years for a woman (assuming retirement at age 65). So, sharing the same vision of retirement (or at least respecting the difference in each other’s visions) seems crucial to retirement happiness. (more…)

Tags: financial advisor charlotte nc, Financial Planning, Personal Finance, retirement, Retirement Planning, Retirement Tax Savings

Cash Flow Management

Jun 12, 2024

You’ve probably heard the saying that “cash is king,” and that truth applies whether you own a business or not. Most discussions of business and personal “financial planning” involve tomorrow’s goals, but those goals may not be realized without attention to cash flow, today.

Management of available cash flow is a key in any kind of financial strategy. Ignore it, and you may inadvertently sabotage your efforts to grow your company or even build personal wealth. (more…)

Tags: Cash Flow, Financial Planning

How To Rollover Your 401(k)?

May 29, 2024

When leaving your job or retiring, you have several options available for managing your retirement plan assets. You may be able to leave the money in your current plan, if your employer allows. Or you can take a lump-sum cash distribution, which will be subject to income tax and a 10% penalty if you’re under age 59½ (unless an exception applies), resulting in a potentially significant tax bill. Finally, you can roll the money into another tax-deferred account, preserving the primary tax advantages. (more…)

Tags: Certified Financial Advisor Charlotte NC, Certified Financial Planner Charlotte NC, financial advisor charlotte nc, Financial Help, Financial Planning, retirement, Retirement Planning, Wealth Building

Retirement and Adult Children

May 8, 2024

Families are one of the great joys in life, and part of the love you show to your family is making sure that their basic needs are met. While that’s only to be expected from birth through the high school years, many households are helping their adult children well into their twenties and beyond at the cost of their own retirement savings. (more…)

Tags: Family Wealth, Financial Planner Charlotte NC, Financial Planning, retirement, Retirement Planning

Conducting a Home Inventory

Apr 3, 2024

A home inventory is a complete and detailed written list of all your personal property that’s located in your home and stored in other structures like garages and toolsheds. It should include your possessions as well as those of family members and others living in your home. You should prepare an inventory whenever you move into a new home. To keep track of new additions and discarded items, be sure to update it every year.

A home inventory is a complete and detailed written list of all your personal property that’s located in your home and stored in other structures like garages and toolsheds. It should include your possessions as well as those of family members and others living in your home. You should prepare an inventory whenever you move into a new home. To keep track of new additions and discarded items, be sure to update it every year.Tags: Current Events, Financial Planner Charlotte NC, Financial Planning, Personal Finance

Six Most Overlooked Tax Deductions

Feb 26, 2024

Who among us wants to pay the Internal Revenue Service more taxes than we have to? While few may raise their hands to voluntarily pay more taxes, Americans regularly overpay because they fail to take tax deductions for which they are eligible. Are you one of them? Let’s take a quick look at the six most overlooked opportunities to manage your tax bill. (more…)

Tags: Financial Planning, Tax Deductions

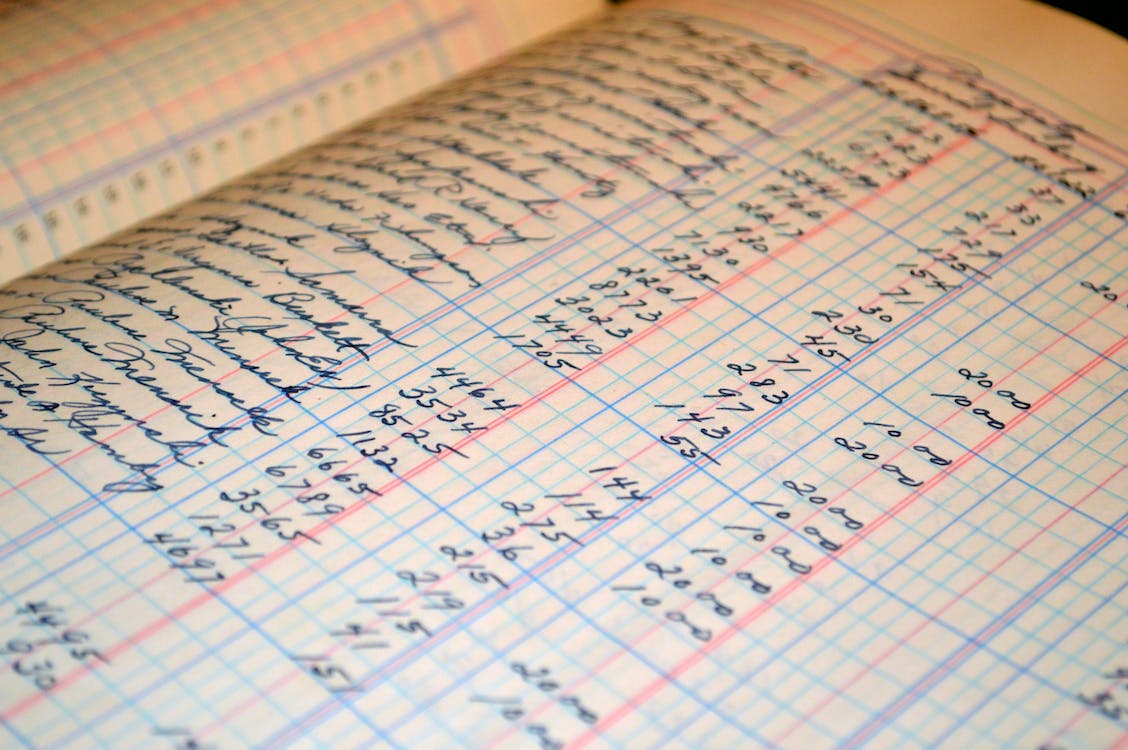

Business Owner Recordkeeping

Nov 27, 2023

Keeping good business records will not only help you stay in business but may also help you increase profits. Your business records let you analyze where your business is and where it’s going. They point out potential trouble spots and serve as a guide to where you want your business to be.

Tags: financial advisor, financial advisor charlotte nc, Financial Planner Charlotte NC, Financial Planning, tax season guide

Medicare Costs Are Increasing in 2024

Nov 13, 2023

Premiums, deductibles, and coinsurance amounts for Original Medicare generally change every year. Here’s a look at some of the costs that will apply in 2024.

Tags: financial advisor charlotte nc, Financial Planning, Health Care Needs, Health Care Savings

More Insights

Key Takeaways Volatility came back with a vengeance this week as selling pressure in the mega cap space dragged down the broader market. Counterbalancing weakness in these heavyweight names poses a challenge for the rest of the market. Overbought conditions can also be blamed for the recent weakness. The S&P 500 reached a 14.9% premium … Continue reading “Market Update – Assessing the Technical Damange”

Life insurance can be an excellent tool for charitable giving. Not only does life insurance allow you to make a substantial gift to charity at relatively little cost to you, but you may also benefit from tax rules that apply to gifts of life insurance.

When you think of Social Security, you probably think of retirement. However, Social Security can also provide much-needed income to your family members when you die, making their financial lives easier. Your family members may be eligible to receive survivor benefits if you worked, paid Social Security taxes, and earned enough work credits. The number … Continue reading “Social Security Survivor Benefits”

Information vs. instinct. When it comes to investment choices, many people believe they have a “knack” for choosing good investments. But what exactly is that “knack” based on? The fact is, the choices we make with our assets can be strongly influenced by factors, many of them emotional, that we may not even be aware … Continue reading “Making Investment Choices”

As a business owner, you should carefully consider the advantages of establishing an employer-sponsored retirement plan. Generally, you’re allowed certain tax benefits for establishing an employer-sponsored retirement plan, including a tax credit for establishing the plan and a deduction for contributions you make. In return, however, you’re required to include certain employees in the plan, … Continue reading “Retirement Plans for Small Businesses”

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page