Business Owner Recordkeeping

Nov 27, 2023

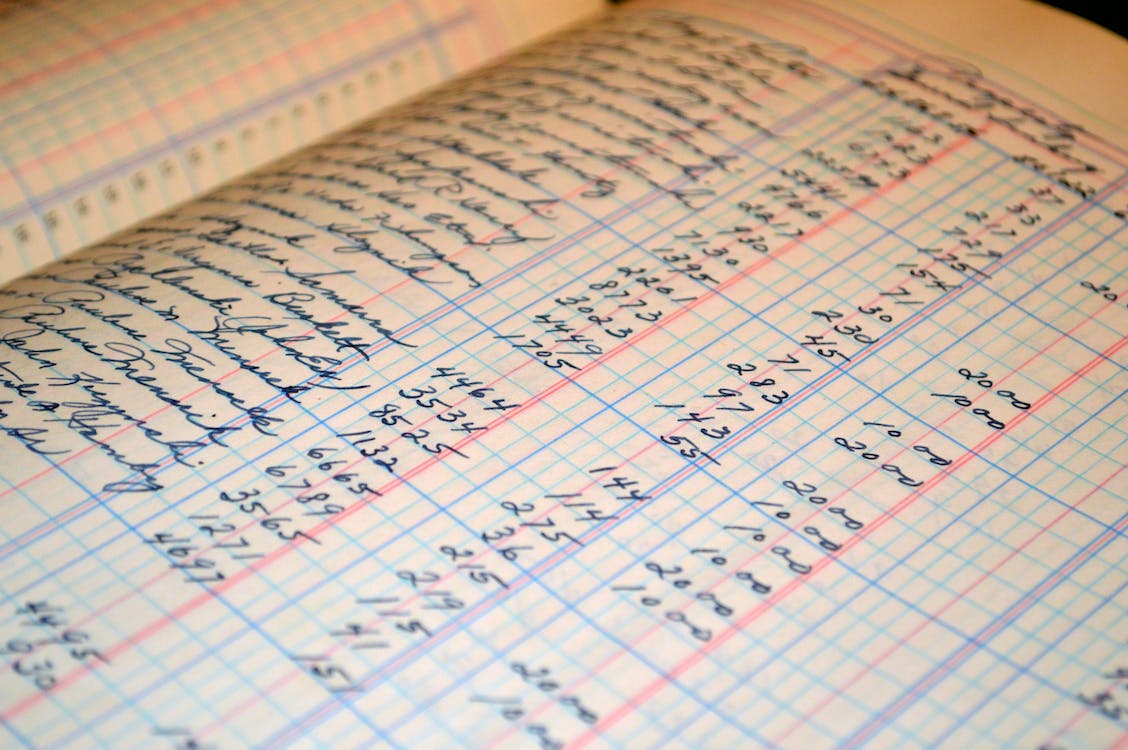

Keeping good business records will not only help you stay in business but may also help you increase profits. Your business records let you analyze where your business is and where it’s going. They point out potential trouble spots and serve as a guide to where you want your business to be.

Your ideal office manager: criteria for record-keeping systems

Like a valued office manager, your record-keeping system should have good work habits. It should be easy to use. If it’s too complicated, it might be neglected, defeating its purpose. It should reflect information accurately, completely, and consistently throughout all of its applications, and it should do so in a timely fashion; you don’t want to base important business decisions on partial or outdated information. Finally, it should present results in an easily understandable manner. If you can’t comprehend the data that your record-keeping system provides, you might ignore their implications.

Some commercial record-keeping systems are generic in format and applicable to many types of business. Others are designed for specific types of business operations (e.g., retail sales and manufacturing). Most generally will offer the ability to summarize your business activity with appropriate periodic financial reports. Many websites allow you to see a demonstration version of the software before you purchase the software.

You can decide whether to keep your own books or hire someone to do it for you. Your decision depends in part on how much time and ability you have for the task. You can hire a company that specializes in payroll services to handle the paperwork and withholdings for your employees. Most small-business advisors suggest that you have an accountant prepare your tax returns and year-end statements. In many cases, an accountant can also offer advice on various aspects of financial management, such as cash flow analysis, borrowing for the business, tax considerations, and suggestions for which software to buy for record keeping. Whichever way you go, you should stay involved in the record-keeping process. After all, it’s your business, and ultimately you are responsible for its success or failure.

What your records should do for you

Like a medical diagnostic tool, your records help you assess the health of your business.

- Bank statements measure cash on hand, and accounts receivable predict future income. Together, these records help determine cash flow requirements and may point to a need for short-term borrowing.

- In addition to providing income tax information to your employees, payroll records help you determine the appropriateness of your pricing and customer billing policies.

- If your business keeps merchandise on hand, your records help you manage the size of your inventory, thus avoiding the loss of profits from obsolescence, deterioration, or simply being out of stock.

- Expense records help you plan to meet obligations in a timely fashion. They also help you assess whether the income generated supports the expense involved.

- Statements of income, or profit and loss statements, help pinpoint unprofitable departments, products, or services, alerting you to make changes or eliminations if necessary.

- The balance sheet captures the condition of your business at a given moment in time, allowing you to measure its reality against either your own budget projections or similar businesses.

Be prepared for tax season

One of the most important functions of business records is to prepare you (or your accountant) for filing tax returns for the business. Thus, you may want to set up a record-keeping system that captures information in a way that matches the demands of the IRS. If you are a sole proprietor, you’ll want to familiarize yourself with the requirements for completing Form 1040, Schedule C.

In addition, Remember to save any records and underlying documentation, such as invoices or receipts, relevant to your tax return for at least three years. Ask your accountant how long he or she suggests keeping the documentation. For more information, see IRS Publication 334, “Tax Guide for Small Business”.

Managing your business records

Records management is vital to any business. You should have a good system in place that will ensure that both your paper (physical) records and your electronic or digital records are retained as long as they need to be. Make sure your records are easily identifiable and accessible, and keep them well-organized. Shred (and recycle) paper records that you do not need or no longer need. Keep your electronic records safe and secure by adding a firewall to your computer and using software that provides adequate security. Back up your computer regularly using a CD, external hard drive, or an online remote back-up service (i.e., in the “cloud”), and be sure to use logins and passwords that are secure. Dispose of e-records carefully.

Tags: financial advisor, financial advisor charlotte nc, Financial Planner Charlotte NC, Financial Planning, tax season guide

More Insights

Key Takeaways Volatility came back with a vengeance this week as selling pressure in the mega cap space dragged down the broader market. Counterbalancing weakness in these heavyweight names poses a challenge for the rest of the market. Overbought conditions can also be blamed for the recent weakness. The S&P 500 reached a 14.9% premium … Continue reading “Market Update – Assessing the Technical Damange”

Life insurance can be an excellent tool for charitable giving. Not only does life insurance allow you to make a substantial gift to charity at relatively little cost to you, but you may also benefit from tax rules that apply to gifts of life insurance.

When you think of Social Security, you probably think of retirement. However, Social Security can also provide much-needed income to your family members when you die, making their financial lives easier. Your family members may be eligible to receive survivor benefits if you worked, paid Social Security taxes, and earned enough work credits. The number … Continue reading “Social Security Survivor Benefits”

Information vs. instinct. When it comes to investment choices, many people believe they have a “knack” for choosing good investments. But what exactly is that “knack” based on? The fact is, the choices we make with our assets can be strongly influenced by factors, many of them emotional, that we may not even be aware … Continue reading “Making Investment Choices”

As a business owner, you should carefully consider the advantages of establishing an employer-sponsored retirement plan. Generally, you’re allowed certain tax benefits for establishing an employer-sponsored retirement plan, including a tax credit for establishing the plan and a deduction for contributions you make. In return, however, you’re required to include certain employees in the plan, … Continue reading “Retirement Plans for Small Businesses”

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page