Will the IPO Market Heat Up?

Oct 8, 2021

If the stock market outlook brightens, there are expectations for a bumper crop of initial public offerings or IPO to make their debuts over the next several weeks.

Somewhere between 90 to 110 IPOs are preparing to come public by the end of the year, which would make 2021 the biggest year for total capital raised since 2000.1 (more…)

Government Debt Goes on a Roller Coaster Ride

Oct 6, 2021

Debates over government debt, taxes, and infrastructure have captured the attention of the nation this week. All eyes are on Washington and Wall Street as these events play out, with potentially far-reaching consequences that seem to shift hour by hour. (more…)

Tags: Current Events, financial advisor charlotte nc, Personal Finance

Chinese Property Market Fallout

Sep 29, 2021

There’s a famous saying about a hurricane starting from a butterfly flapping its wings on the other side of the world. That “butterfly effect” is certainly happening in terms of the Chinese property market influence on financial markets around the world. (more…)

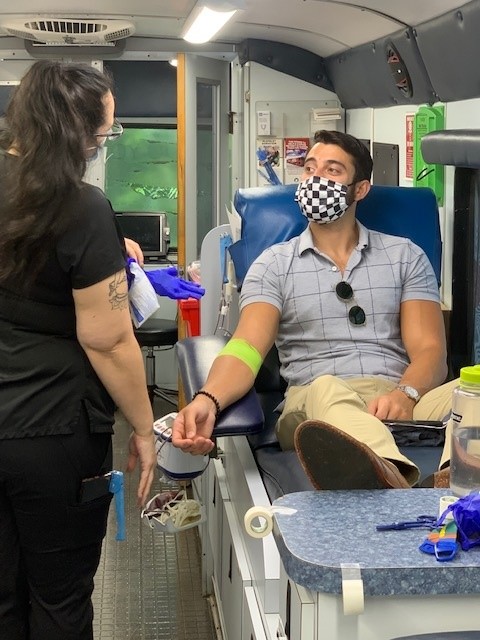

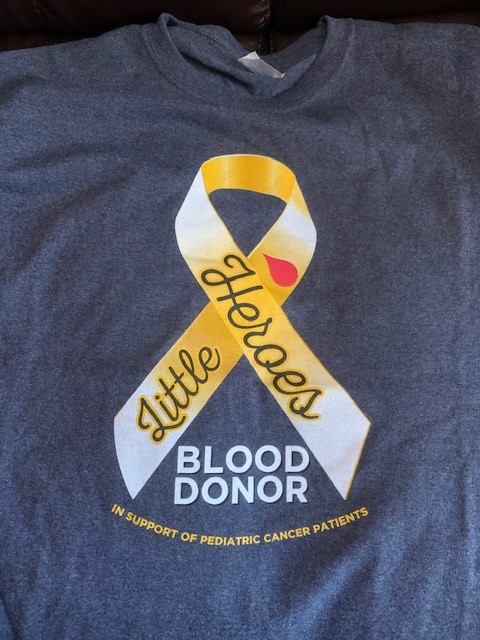

Little Heros Blood Drive

Sep 27, 2021

There is probably nothing that pulls at the heart-strings more than a sick child or a child in need. Imagine getting the news that your child has cancer. Its tough for any parent to even think about that, let alone live it. Through the OneBlood organization and the Little Heros Campaign here in Charlotte, 40 mobile unit blood drives have been set up throughout the month of September (and into early October) to allow each of us to help save a child who may be fighting the battle of his life … or fighting for his life. Managing Director Ed Doughty and Financial Advisor Jason Dimitriou both donated their blood in honor of Liam Flynn, the young son of personal friend who is actually the one who helped to organize the month-long blood drive. Donating blood is such a simple way to “give”, but the results of your giving can literally help to save a life. We were grateful for the opportunity to give, and would encourage everyone to considering donating to the Little Heros Blood Drive. You can simply enter your zip-code and find a listing of all the remaining blood drives near year. Go to: Little Heros Blood Drive

Talking to Your Heirs About Your Estate Plan

Sep 27, 2021

Talking about “the end” is not the easiest thing to do, and this is one reason why some people never adequately plan for the transfer of their wealth. Those who do create estate plans with help from financial and legal professionals sometimes leave their heirs out of the conversation. (more…)

Tags: Estate Planning, Family Wealth, financial advisor charlotte nc

Are Your Taxes Going to Change?

Sep 24, 2021

Most likely, you’ve heard what’s brewing in Washington, D.C. called by one of these names. The Build Back Better Act. Or the $3.5 trillion budget reconciliation bill. Or the Jobs and Economic Recovery Plan for Working Families. But could it affect your taxes? (more…)

Tags: Current Events, financial advisor charlotte nc, tax guide, Tax Planning, taxes

The Under Utilized Benefits of a Health Savings Account

Sep 22, 2021

Healthcare can be one of the priciest yet essential parts of life’s journey. And yet, many struggle to utilize the financial tools that may help. Take Health Saving Account (HSAs), for example. (more…)

Tags: financial advisor charlotte nc, Health Care Needs, Health Care Savings

The Best, the Brightest, and Inflation

Sep 20, 2021

If you are feeling a bit confused about the direction of inflation, you’re in good company. Some of the best and brightest economists in the country are having a tough time getting their arms around the current inflation trends.

The most recent Producer Price Index reading came in above economists’ estimates at a record level of 8.3% compared with a year earlier. Producer prices can be an indicator of future price changes at the consumer level.

One way to gauge inflation is to watch the people responsible for managing inflation – the Federal Reserve’s Board of Governors. In recent weeks, several governors have indicated they are comfortable with how the economy is recovering. So comfortable that they appear ready to slightly change course with monetary policy in the next few months.2

Does that mean inflation will be lower in six to nine months? Time will tell, but keeping an eye on the Fed’s actions may be one of the best ways to see what’s next for prices.

Remember, inflation is just one factor to consider when making adjustments to a portfolio. But if you’re getting uncomfortable, please reach out. We welcome the chance to speak with you if you see higher prices.

For more insights and resources, be sure to sign up for our Weekly Market Commentary. Follow our YouTube channel where we regularly post our Epic Market Minute videos. Follow us on LinkedIn, or like us on Facebook. And as always, please don’t hesitate to reach out to a dedicated service professional at Epic Capital.

The Bull Market Continues … For Now

Sep 15, 2021

The bull market continues, with the S&P 500 Index now up seven months in a row. Stocks have impressively gained 20% year-to-date, with the S&P 500 making 53 new all-time highs before the end of August—another new record. All of this has happened with very little volatility, as the S&P 500 hasn’t had so much as a 5% pullback since last October. (more…)

Tags: Certified Financial Planner Charlotte NC, Current Events, financial advisor charlotte nc, Investment Planning, Personal Finance

Making Sense of Seemingly Inconsistent Numbers

Sep 13, 2021

It can be incredibly difficult to make sense of data. A report coming from one body may tell you one thing, and another report might seem to offer a wholly different perspective. (more…)

More Insights

You’re beginning to accumulate substantial wealth, but you worry about protecting it from future potential creditors. Whether your concern is for your personal assets or your business, various tools exist to keep your property safe from tax collectors, accident victims, health-care providers, credit card issuers, business creditors, and creditors of others. To insulate your property … Continue reading “Estate Planning – Protecting Your Assets”

You know how important it is to plan for your retirement, but where do you begin? One of your first steps should be to estimate how much income you’ll need to fund your retirement. That’s not as easy as it sounds, because retirement planning is not an exact science. Your specific needs depend on your … Continue reading “Estimating Your Retirement Income Needs”

As June begins, markets continue to navigate a complex landscape shaped by trade policy shifts, an uncertain economic and earnings outlook, and bond market headwinds. Several key developments in recent weeks may have implications for markets:

April showers came a month early as stocks fell in March. Tariffs were the primary cause of the market jitters, although that uncertainty became too much for markets to shrug off once economic data started to weaken.

A successful investor maximizes gain and minimizes loss. Though there can be no guarantee that any investment strategy will be successful and all investing involves risk, including the possible loss of principal, here are six basic principles that may help you invest more successfully.

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page