Planning Ahead for Life Insurance Proceeds

Jan 19, 2024

Why did you purchase life insurance? If you’re like most people who buy life insurance, you’re looking to provide a source of income for someone (e.g., a spouse, parent, or child) after you die. Buying the policy was the first step. Now you’ll need to do a little more work to ensure that the money you leave behind lasts.

Why did you purchase life insurance? If you’re like most people who buy life insurance, you’re looking to provide a source of income for someone (e.g., a spouse, parent, or child) after you die. Buying the policy was the first step. Now you’ll need to do a little more work to ensure that the money you leave behind lasts.Social Security Survivor Benefits

Jan 17, 2024

When you think of Social Security, you probably think of retirement. However, Social Security can also provide much-needed income to your family members when you die, making their financial lives easier.

When you think of Social Security, you probably think of retirement. However, Social Security can also provide much-needed income to your family members when you die, making their financial lives easier.Your family members may be eligible to receive survivor benefits if you worked, paid Social Security taxes, and earned enough work credits. The number of credits you need depends on your age when you die. The younger you are when you die, the fewer credits you’ll need for survivor benefits. However, no one needs more than 40 credits (10 years of work) to be “fully insured” for benefits. And under a special rule, if you’re only “currently insured” at the time of your death (i.e., you have 6 credits in the 13 quarters prior to your death), your children and your spouse who is caring for them can still receive benefits.

Tags: Certified Financial Planner Charlotte NC, Family Wealth, financial advisor charlotte nc, Financial Help, Financial Planner Charlotte NC

Time and Money – The Power of Compounding

Jan 12, 2024

Father Time doesn’t always have a good reputation, particularly when it comes to birthdays. But when it comes to saving for retirement, time might be one of your strongest allies. Why? When time teams up with the growth potential of compounding, the results can be powerful.

Father Time doesn’t always have a good reputation, particularly when it comes to birthdays. But when it comes to saving for retirement, time might be one of your strongest allies. Why? When time teams up with the growth potential of compounding, the results can be powerful.

Tags: Certified Financial Planner Charlotte NC, financial advisor, Retirement Planning

Wills: The Cornerstone of Your Estate Plan

Jan 8, 2024

If you care about what happens to your money, home, and other property after you die, you need to do some estate planning. There are many tools you can use to achieve your estate planning goals, but a will is probably the most vital. Even if you’re young or your estate is modest, you should always have a legally valid and up-to-date will. This is especially important if you have minor children because, in many states, your will is the only legal way you can name a guardian for them. Although a will doesn’t have to be drafted by an attorney to be valid, seeking an attorney’s help can ensure that your will accomplishes what you intend.

Tags: Certified Financial Advisor Charlotte NC, Certified Financial Planner Charlotte NC, Estate Planning, Retirement Planning, Retirement Tax Savings, tax guide, Wealth Building

Chapters of Retirement

Jan 5, 2024

The journey to and through retirement occurs gradually, like successive chapters in a book. Each chapter has its own things to consider. (more…)

Tags: Investment Planning, retirement, Retirement Planning

Important Lessons from 2023

Jan 3, 2024

Stocks defied the skeptics in a very unpredictable 2023. The Dow Jones finished at an all-time record high on December 28, and the S&P 500 came within a whisker of a fresh all-time high after the index rallied more than 20% for the year. (more…)

Stocks defied the skeptics in a very unpredictable 2023. The Dow Jones finished at an all-time record high on December 28, and the S&P 500 came within a whisker of a fresh all-time high after the index rallied more than 20% for the year. (more…)

Tags: Current Events

Medicaid and Your Primary Residence

Dec 22, 2023

Although your stay can be paid for by your personal savings or by your long-term care insurance policy (if you have one), many nursing home residents end up using Medicaid (a joint federal-state program for low-income individuals) to pay for their care. Unfortunately, if you’re a Medicaid beneficiary, your state may be able to attach a lien to your house while you’re living or after you die. To preserve the home for your family, you should plan for Medicaid well in advance of your nursing home stay. If you’re like most homeowners, your principal residence is one of your most valuable assets. It may have sentimental value, and it may also represent financial security for your loved ones.

Although your stay can be paid for by your personal savings or by your long-term care insurance policy (if you have one), many nursing home residents end up using Medicaid (a joint federal-state program for low-income individuals) to pay for their care. Unfortunately, if you’re a Medicaid beneficiary, your state may be able to attach a lien to your house while you’re living or after you die. To preserve the home for your family, you should plan for Medicaid well in advance of your nursing home stay. If you’re like most homeowners, your principal residence is one of your most valuable assets. It may have sentimental value, and it may also represent financial security for your loved ones.Charitable Gifting in Your Estate Plan

Dec 20, 2023

When developing your estate plan, you can do well by doing good. Leaving money to charity rewards you in many ways. It gives you a sense of personal satisfaction, and it can save you money in estate taxes.

When developing your estate plan, you can do well by doing good. Leaving money to charity rewards you in many ways. It gives you a sense of personal satisfaction, and it can save you money in estate taxes.Market Update – Dow Rallies to Record Highs

Dec 18, 2023

Key Takeaways

Key Takeaways

- The Dow Jones Industrial Average (INDU) has gone from correction to record highs in only 32 trading days. Broadening participation predicated on falling interest rates and signs of a soft-landing scenario have underpinned the recovery.

- What happens after a record high? Over the last 100 years, and filtering for record highs occurring at least three months apart, upside momentum has historically continued. The INDU has generated an average 12-month forward return of 11.1% after posting a new record high, with 71% of occurrences producing positive results.

- And with the INDU already at record highs, all eyes are now on the Dow Jones Transportation Average (TRAN) to confirm the breakout, per Dow Theory.

- LPL Research views the INDU’s recent record-high rally as another piece of evidence supporting the health and sustainability of the current bull market.

It only took 489 trading days, but the INDU climbed back into record-high territory this week. Broadening participation in the equity market recovery has lifted the index 15% above its recent October low and above the prior January 4, 2022 record high of 36,800. (more…)

Tags: Current Events

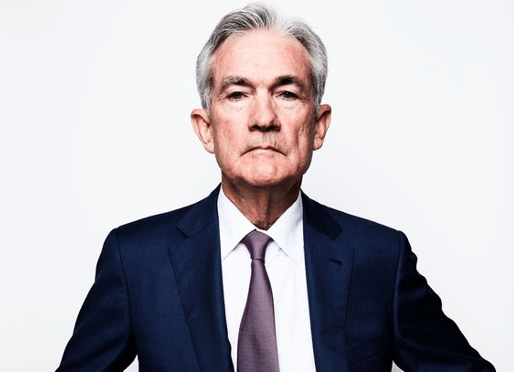

Preparing for the Fed Pivot

Dec 15, 2023

Key Takeaways:

Key Takeaways:

- Since inflation is going in the right direction and the labor market is getting more into balance, the Federal Reserve (Fed) is likely done raising rates. We should expect the committee to prepare investors for a slight pivot in policy.

- The markets expect the Fed’s next action will likely be a cut in rates by mid next year but much of that is predicated on the economy weakening enough to warrant a cut.

- Both equity and bond markets have latched onto the notion that the Fed is done raising rates which has been a catalyst for the recent rally.

- The updated Summary of Economic Projections (SEP) will likely push back on the market’s expectations that the Fed will cut rates by over a full percentage point. But the

SEP is a poor predictor of future rates.

More Insights

It seems like we just can’t stop talking about the Federal Reserve (Fed). After an aggressive rate hiking campaign that we think ended last year, markets were expecting the Fed to start cutting interest rates as early as next month. But withan economy that continues to surprise to the upside, along with inflationary pressures that … Continue reading “Market Update – The Patient Pause”

A thoughtful retirement strategy may help you pursue your many retirement goals. That strategy must consider many factors, and here are just a few: your income needs, the order of your withdrawals from taxable and tax-advantaged retirement accounts, the income tax implications of those withdrawals, and sequence of return risk.

Losing a spouse is a stressful transition. And the added pressure of having to settle the estate and organize finances can be overwhelming. Fortunately, there are steps you can take to make dealing with these matters less difficult.

Ever hear of critical illness insurance? This isn’t standard-issue disability insurance, but a cousin of sorts. With people living longer, it is a risk management option entering more people’s lives.

Following Iran’s missile and drone strikes on Israel over the weekend and the apparent escalation likely in any Israeli response, stocks fell sharply during Monday’s trading session. We examine the latest developments in the Middle East conflict, how stocks have reacted historically to geopolitical events, and the possible impact on markets moving forward.

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page