Oil Prices Hit Six-Year High

Jul 14, 2021

On July 6, oil prices reached a six-year high of $76.98 a barrel. This benchmark came as the Organization of the Petroleum Exporting Countries (OPEC) and allies failed to reach an agreement regarding an increase in production.1

This rise in cost follows a year in which OPEC and allies cut production amidst the COVID-19 pandemic. As a surge in demand rises, production has yet to ramp up to pre-pandemic levels. This idea of “demand being greater than supply” should sound familiar, as we’ve seen similar economic trends in everything from semiconductors to lumber and cars. (more…)

Tags: Current Events

Conducting Your Mid Year Financial Review

Jul 9, 2021

With June officially behind us, it’s time to face the facts: we’re headed toward the second half of 2021. While there’s still plenty of time to enjoy the rest of summer, we encourage you to slow down and check up on your financial well-being. Is your mid year review scheduled? (more…)

Tags: financial advisor, financial advisor charlotte nc, Investment Portfolio, Personal Finance, Retirement Planning

Ways to Fund A Special Needs Trust

Jul 7, 2021

If you have a child with special needs, a special needs trust may be a financial priority. There are many crucial goods and services that Medicaid and Supplemental Security Income might not pay for, and a special needs trust may be used to address those financial challenges. Most importantly, a special needs trust may help provide for your disabled child in case you’re no longer able to care for them. (more…)

Tags: financial advisor charlotte nc, Health Care Needs, Health Care Savings, Insurance, Investing, Investment Planning, Legacy, Long-Term Care Planning, Wealth Building

An Estate Strategy for Your Digital Assets

Jul 5, 2021

When you think about your estate, you may think about your personal property, real estate, or investments. You also have other, less-tangible assets – and they deserve your attention as well.

Your digital assets should not disappear into a void when you die. Nor should they be stolen by thieves. You can direct that they be transferred, preserved, or destroyed per your instructions. Your digital assets may include information on your phone and computer, content that you uploaded to Facebook, Instagram, or other websites, your intellectual/creative stake in certain digital property, and records stemming from online communications. (That last category includes your emails and text messages.)

Think of it this way: each password-protected account that you have signifies a digital asset. You may feel that some of these accounts have little (more…)

Tags: charlotte NC, financial advisor, Retirement Planning

Thinking About Summer Travel

Jul 2, 2021

Summertime rouses our desire to hit the road (or the airport) and travel. Here are a few things you’ll want to consider before you take off. (more…)

Economic Lessons from Used-Car Inflation

Jun 30, 2021

Inflation is defined as the general upward price movement of goods and services in an economy. The key word is “general.” Inflation tends to be uneven and affects the price of some items more than others. (more…)

The Cryptocurrency Conundrum

Jun 25, 2021

Recently, you may have seen a number of major cryptocurrencies fall thanks to a continuing sell-off that began last week. In fact, over $250 billion was lost in the crypto market alone.1

It may be more tempting to view this as another volatile moment in the crypto markets, but there’s more at work here than a temporary trend towards selling. (more…)

The Fed Acknowledges Inflation

Jun 23, 2021

At its June meeting, the Federal Reserve confirmed what many of us have suspected for some time: prices are rising. In fact, prices are climbing faster than many expected. In response, the Fed raised its inflation expectation to 3.4%, up from its March projection of 2.4%, effectively raising its inflation expectation by 42%.1 (more…)

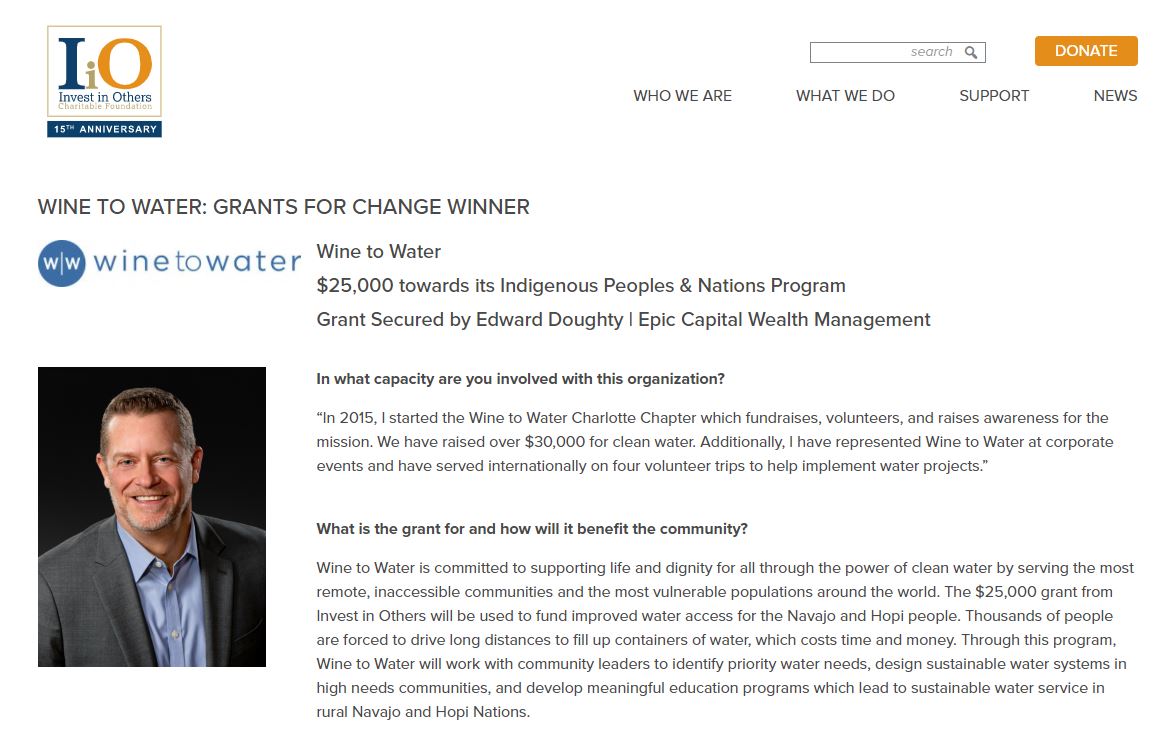

Invest in Others Selects Wine to Water for $25,000 Grant!

Jun 22, 2021

We are so excited to announce that Wine To Water and their new Navajo and Hopi Nations water project has been selected as a recipient for a $25,000 grant from the Invest in Others Charitable Foundation!! What a blessing, and what an impact it will have on the indigenous peoples right here in the United States.

We are so excited to announce that Wine To Water and their new Navajo and Hopi Nations water project has been selected as a recipient for a $25,000 grant from the Invest in Others Charitable Foundation!! What a blessing, and what an impact it will have on the indigenous peoples right here in the United States.

Summer Travel is Back

Jun 21, 2021

One of the most anticipated comebacks of 2021 isn’t an athlete, rock star, or movie franchise. It’s summer travel, and it appears to be back with a vengeance.

Travel agents are working 14-hour days to meet the needs of eager travelers. People aren’t just taking road trips, either; airports are reporting being at 80% of pre-COVID capacity, while the TSA screenings reached two million for the first time since the pandemic. (more…)

Tags: Current Events, financial advisor charlotte nc

More Insights

You’re beginning to accumulate substantial wealth, but you worry about protecting it from future potential creditors. Whether your concern is for your personal assets or your business, various tools exist to keep your property safe from tax collectors, accident victims, health-care providers, credit card issuers, business creditors, and creditors of others. To insulate your property … Continue reading “Estate Planning – Protecting Your Assets”

You know how important it is to plan for your retirement, but where do you begin? One of your first steps should be to estimate how much income you’ll need to fund your retirement. That’s not as easy as it sounds, because retirement planning is not an exact science. Your specific needs depend on your … Continue reading “Estimating Your Retirement Income Needs”

As June begins, markets continue to navigate a complex landscape shaped by trade policy shifts, an uncertain economic and earnings outlook, and bond market headwinds. Several key developments in recent weeks may have implications for markets:

April showers came a month early as stocks fell in March. Tariffs were the primary cause of the market jitters, although that uncertainty became too much for markets to shrug off once economic data started to weaken.

A successful investor maximizes gain and minimizes loss. Though there can be no guarantee that any investment strategy will be successful and all investing involves risk, including the possible loss of principal, here are six basic principles that may help you invest more successfully.

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page