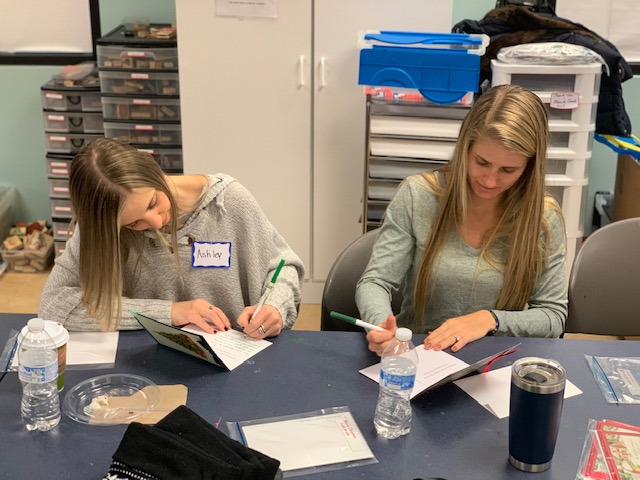

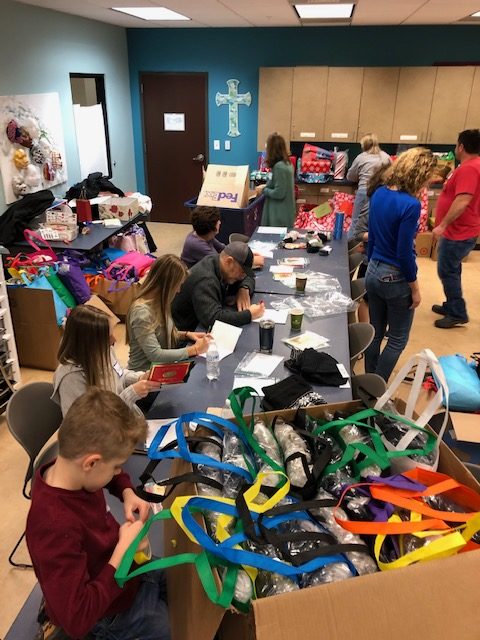

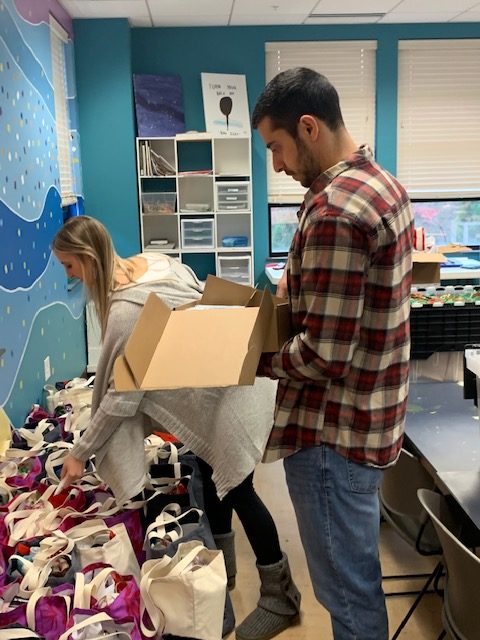

Dove’s Nest – Charlotte Rescue Mission

Dec 21, 2019

It was such a privilege to be the group that assembled the gift bags that were opened on Christmas morning by the women and children at Dove’s Nest. It was a clear reminder that the Christmas season truly is about giving, not just presents, but giving of one’s self for others, sharing our time and hearts and doing what we can to lift others up, to empower them, and to give them the dignity they deserve no matter their circumstances or life story. It’s also a perfect time to reflect on how blessed we are, and how grateful we are for the families that we serve doing the work we do at Epic Capital.

It was such a privilege to be the group that assembled the gift bags that were opened on Christmas morning by the women and children at Dove’s Nest. It was a clear reminder that the Christmas season truly is about giving, not just presents, but giving of one’s self for others, sharing our time and hearts and doing what we can to lift others up, to empower them, and to give them the dignity they deserve no matter their circumstances or life story. It’s also a perfect time to reflect on how blessed we are, and how grateful we are for the families that we serve doing the work we do at Epic Capital.

Dove’s Nest, Charlotte Rescue Mission’s cost-free women’s recovery program provides a structured yet loving and stable living environment aimed at helping women understand and deal with the core issues of addiction as a disease. The 120-Day program welcomes mothers with their children and focuses on spiritual, physical, social and psychological recovery, to help women understand and deal with the core issues of their alcohol and/or drug addiction. If you’d like to learn more about this extraordinary facility and program, please visit their website or give them a call @ 704-333-4673.

Four Words You Shouldn’t Believe

Dec 18, 2019

“This time is different.” Beware those four little words. They are perhaps the most dangerous words an investor can believe in. If you believe “this time is different,” you are mentally positioning yourself to exit the stock market and make impulsive, short-sighted decisions with your money. This is the belief that has made too many investors miss out on the best market days and scramble to catch up with Wall Street recoveries.

Stock market investing is a long-term proposition – which is true for most forms of investing. Any form of long-range investing demands a certain temperament. You must be patient, you must be dedicated to realizing your objectives, and you can’t let short-term headlines deter you from your long-term quest. (more…)

Tags: Investing, Investment Planning

A Retirement Facts Sheet

Dec 16, 2019

Does your vision of retirement align with the facts? Here are some noteworthy financial and lifestyle facts about life after 50 that might surprise you.

Up to 85% of a retiree’s Social Security income can be taxed. Some retirees are taken aback when they discover this. In addition to the Internal Revenue Service, 13 states currently levy taxes on some or all Social Security retirement benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. (West Virginia, incidentally, is phasing out such taxation.) (more…)

Tags: financial advisor charlotte nc, Retirement Planning

New I.R.S. Contribution Limits

Dec 13, 2019

The I.R.S. just increased the annual contribution limits on IRAs, 401(k)s, and other widely used retirement plan accounts for 2020. Here’s a quick look at the changes. (more…)

Tags: Retirement Planning

Establishing Good Credit in College

Dec 9, 2019

Good credit may open doors. It is vital to securing a loan, a business loan, or buying a home. When you establish and maintain good credit in college, you create a financial profile for yourself that can influence lenders, landlords, and potential employers.

Unfortunately, some college students do not have good credit. In fact, Credit Karma says that the average 18-to-24-year-old has a credit score of 630. A FICO score of 730 or higher is considered good. (more…)

Tags: Credit Repair, Financial Planner Charlotte NC, Financial Planning

Can You Put Your IRA into a Trust?

Dec 2, 2019

Can your IRA be put directly into a trust? In short, no. Individual retirement accounts (IRAs) cannot be put directly into a trust. What you can do, however, is name a trust as the beneficiary of your IRA. The trust would inherit the IRA upon your passing, and your beneficiaries would then have access to the funds, according to the terms of the trust.

Can you control what happens to your IRA assets after your death? Yes. Whoever was named the beneficiary will inherit the IRA. But you also can name a trust as the IRA beneficiary. In other words, your chosen heir is a trust. When you have a trust in place, you control not only to whom your assets will be disbursed, but also how those assets will be paid out. (more…)

Tags: financial advisor charlotte nc, ira

Facts About Medicare Open Enrollment

Nov 27, 2019

Medicare’s open enrollment period runs through December 7th. If you are enrolling in Medicare for the first time, you will discover that it is much more complex than an employer-sponsored group health plan.

When you are enrolled in Medicare, you pay multiple premiums for multiple types of coverage (Parts A and B as well as the Part D prescription drug plan), and unlike a group health plan, there are no caps on out-of-pocket costs and a risk that you might have to pay a hospital insurance deductible more than once per year. Original Medicare also does not cover some costs that many seniors would like to cover, such as dental and vision care expenses. (more…)

Tags: financial advisor charlotte nc, Health Care Needs, Medicare

What If You Get Audited?

Nov 20, 2019

“Audit” is a word that can strike fear into the hearts of taxpayers.

However, the chances of an Internal Revenue Service audit aren’t that high. In 2017, the most recent statistics available, show the I.R.S. audited 0.5% of all individual tax returns.

Being audited does not necessarily imply that the I.R.S. suspects wrongdoing. The I.R.S. says that an audit is just a formal review of a tax return to ensure information is being reported according to current tax law and to verify that the information itself is accurate. (more…)

Tags: financial advisor, Tax Audit

Trust Deed Investments

Nov 18, 2019

Trust deeds may seem to be a fairly straightforward form of financial investment. You may have heard of them in passing without being certain exactly what they are. It’s also referred to as a private trust deed.

What are they? At the core, these private trust deeds are sort of like mortgages that are used by real estate investors to borrow money to purchase property or finance buildings. The “sort of” part comes from the fact that these private trust deeds are not exactly like the mortgage a homeowner might take from a bank or other mortgage lender to buy a house. (more…)

Tags: financial advisor, Investing, Investment Planning

Insurance When You’re Newly Married

Nov 15, 2019

Marriage changes everything, including insurance needs. Newly married couples should consider a comprehensive review of their current, individual insurance coverage to determine if any changes are in order as well as consider new insurance coverage appropriate to their new life stage.

The good news is that married drivers may be eligible for lower rates than single drivers. Since most couples come into their marriage with two separate auto policies, you should review your existing policies and contact your respective insurance companies to obtain competitive quotes on a new, combined policy. (more…)

Tags: Financial Planning, Insurance

More Insights

You’re beginning to accumulate substantial wealth, but you worry about protecting it from future potential creditors. Whether your concern is for your personal assets or your business, various tools exist to keep your property safe from tax collectors, accident victims, health-care providers, credit card issuers, business creditors, and creditors of others. To insulate your property … Continue reading “Estate Planning – Protecting Your Assets”

You know how important it is to plan for your retirement, but where do you begin? One of your first steps should be to estimate how much income you’ll need to fund your retirement. That’s not as easy as it sounds, because retirement planning is not an exact science. Your specific needs depend on your … Continue reading “Estimating Your Retirement Income Needs”

As June begins, markets continue to navigate a complex landscape shaped by trade policy shifts, an uncertain economic and earnings outlook, and bond market headwinds. Several key developments in recent weeks may have implications for markets:

April showers came a month early as stocks fell in March. Tariffs were the primary cause of the market jitters, although that uncertainty became too much for markets to shrug off once economic data started to weaken.

A successful investor maximizes gain and minimizes loss. Though there can be no guarantee that any investment strategy will be successful and all investing involves risk, including the possible loss of principal, here are six basic principles that may help you invest more successfully.

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page