Business Owner Recordkeeping

Nov 27, 2023

Keeping good business records will not only help you stay in business but may also help you increase profits. Your business records let you analyze where your business is and where it’s going. They point out potential trouble spots and serve as a guide to where you want your business to be.

Tags: financial advisor, financial advisor charlotte nc, Financial Planner Charlotte NC, Financial Planning, tax season guide

Five Things We’re Thankful For: Fixed Income Edition

Nov 22, 2023

There’s no doubt the last few years have been challenging for fixed income investors. And while 2023 was supposed to be the year for bonds, fixed income returns for most core bond categories have only recently turned positive for the year. That said, despite the recent challenges, we think there are several reasons to be thankful (optimistic) about the current set-up within fixed income. As such, below are five things we’re thankful for within the fixed income markets. (more…)

There’s no doubt the last few years have been challenging for fixed income investors. And while 2023 was supposed to be the year for bonds, fixed income returns for most core bond categories have only recently turned positive for the year. That said, despite the recent challenges, we think there are several reasons to be thankful (optimistic) about the current set-up within fixed income. As such, below are five things we’re thankful for within the fixed income markets. (more…)

What Business Entity Should I Create?

Nov 17, 2023

Now that you’ve decided to start a new business or buy an existing one, you need to consider the form of business entity that’s right for you. Basically, three separate categories of entities exist: partnerships, corporations, and limited liability companies. Each category has its own advantages, disadvantages, and special rules. It’s also possible to operate your business as a sole proprietorship without organizing as a separate business entity.

Now that you’ve decided to start a new business or buy an existing one, you need to consider the form of business entity that’s right for you. Basically, three separate categories of entities exist: partnerships, corporations, and limited liability companies. Each category has its own advantages, disadvantages, and special rules. It’s also possible to operate your business as a sole proprietorship without organizing as a separate business entity.High-Income Individuals Face New Medicare-Related Taxes

Nov 15, 2023

The health-care reform legislation enacted in 2010 included new Medicare-related taxes that first took effect in 2013. These new taxes target high-income individuals and families. Here are the basics:

Medicare Costs Are Increasing in 2024

Nov 13, 2023

Premiums, deductibles, and coinsurance amounts for Original Medicare generally change every year. Here’s a look at some of the costs that will apply in 2024.

Tags: financial advisor charlotte nc, Financial Planning, Health Care Needs, Health Care Savings

What are the Best Housing Options for Seniors?

Nov 10, 2023

As you grow older, your housing needs may change. Maybe you’ll get tired of doing yardwork. You might want to retire in sunny Florida or live close to your grandchildren in Illinois. Perhaps you’ll need to live in a nursing home or an assisted-living facility. Or, after considering your options, you may even decide to stay where you are. When the time comes to evaluate your housing situation, you’ll have numerous options available to you.

As you grow older, your housing needs may change. Maybe you’ll get tired of doing yardwork. You might want to retire in sunny Florida or live close to your grandchildren in Illinois. Perhaps you’ll need to live in a nursing home or an assisted-living facility. Or, after considering your options, you may even decide to stay where you are. When the time comes to evaluate your housing situation, you’ll have numerous options available to you.Tags: Certified Financial Planner Charlotte NC, financial advisor, financial advisor charlotte nc

Can You Borrow Money From Your 401(k) Plan?

Nov 8, 2023

If you have a 401(k) plan at work and need some cash, you might be tempted to borrow or withdraw money from it. But keep in mind that the purpose of a 401(k) is to save for retirement. Take money out of it now, and you’ll risk running out of money during retirement. You may also face stiff tax consequences and penalties for withdrawing money before age 59½. Still, if you’re facing a financial emergency — for instance, your child’s college tuition is almost due and your 401(k) is your only source of available funds — borrowing or withdrawing money from your 401(k) may be your only option.

If you have a 401(k) plan at work and need some cash, you might be tempted to borrow or withdraw money from it. But keep in mind that the purpose of a 401(k) is to save for retirement. Take money out of it now, and you’ll risk running out of money during retirement. You may also face stiff tax consequences and penalties for withdrawing money before age 59½. Still, if you’re facing a financial emergency — for instance, your child’s college tuition is almost due and your 401(k) is your only source of available funds — borrowing or withdrawing money from your 401(k) may be your only option.Market Update – Call it a Comeback?

Nov 6, 2023

- Oversold conditions and tumbling interest rates have brought buyers back into equity markets this week. The S&P 500 has recaptured its closely watched 200-day moving average (dma).

- Historically, index returns following a move back above the 200-dma have yielded positive but underwhelming returns, suggesting crossovers should be used more as a confirmation of trend than a binary trading signal.

- Seasonal tailwinds could keep this recovery moving forward. The S&P 500 has generated an average return of 7.0% from November through April, marking the best six-month return period for the market since 1950.

- While the comeback in stocks this week has been constructive, there is more technical work to do before considering that the correction is complete. Specifically, we are watching for the S&P 500 to clear resistance at 4,400, for market breadth to expand, and for 10-year yields to reverse their current uptrend.

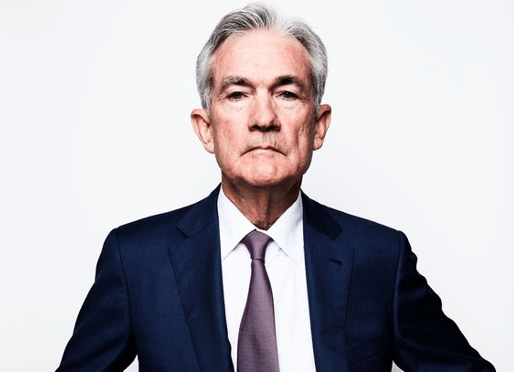

Market Update: The Fed Remains Unchanged Again

Nov 3, 2023

In a unanimous decision yesterday, The Federal Reserve (Fed) left interest rates unchanged following its Federal Open Market Committee (FOMC) meeting. This marks the second straight meeting in which a rate hike was skipped, however, Chair Jerome Powell, didn’t rule out future increases. For now, the target rate remains at 5.25%-5.50%. Markets reacted positively to the news as stock prices rallied and bond yields fell. (more…)

Market Update: Spending Growing Faster Than Income

Oct 30, 2023

- Adjusted for inflation, consumers increased spending in each of the last four months while real disposable income fell over the same period. Clearly, this can’t last much longer.

- Auto incentives brought in buyers last month as real spending on goods was driven by spending on autos, both new and used. The use of incentives obviously has implications for profit margins in the near future.

- Not surprisingly, international travel was the largest contributor to the increase in real services spending in September. Airlines should not expect this level of spending in coming months.

- The annual core inflation metric decelerated to 3.7% from 3.8% in August and 4.3% in July.

- Markets will likely struggle with processing the sharp 0.8% monthly rise in restaurant and hotel prices, the highest rate since October.

- Bottom Line: Although consumer prices rose faster than expected from a month ago, core inflation continues to lose speed and this report will not likely change the Fed’s view that inflation will slow in coming months as demand slows. Eventually, spending will moderate after consumers spend more than they earn for several more months.

More Insights

April showers came a month early as stocks fell in March. Tariffs were the primary cause of the market jitters, although that uncertainty became too much for markets to shrug off once economic data started to weaken.

A successful investor maximizes gain and minimizes loss. Though there can be no guarantee that any investment strategy will be successful and all investing involves risk, including the possible loss of principal, here are six basic principles that may help you invest more successfully.

Losing a spouse is a stressful transition. And the added pressure of having to settle the estate and organize finances can be overwhelming. Fortunately, there are steps you can take to make dealing with these matters less difficult.

Families are one of the great joys in life, and part of the love you show to your family is making sure that their basic needs are met. While that’s only to be expected from birth through the high school years, many households are helping their adult children well into their twenties and beyond at … Continue reading “Retirement and Adult Children”

Life insurance can be an excellent tool for charitable giving. Not only does life insurance allow you to make a substantial gift to charity at relatively little cost to you, but you may also benefit from tax rules that apply to gifts of life insurance.

Services

Epic Capital provides the following comprehensive financial planning and investment management services: Learn More >

Top of Page

Top of Page